Available by Email Only!

______________________________________________________________________________________________

AV Special Bulletin

# 17 1-20-25

______________________________________________________________________________________________

Bond

Market to FED: not so fast ! |

======================================================

"Helping investors make informed decisions

since 1985”

======================================================

The following information is the opinion of Jim

Patton, Broker and is based on his view of the

Antelope Valley real estate market & the economy. Political

issues may be discussed if their outcome could have a meaningful

effect on the nation’s economy. Redistribution

of this report is encouraged.

======================================================

Intro………..

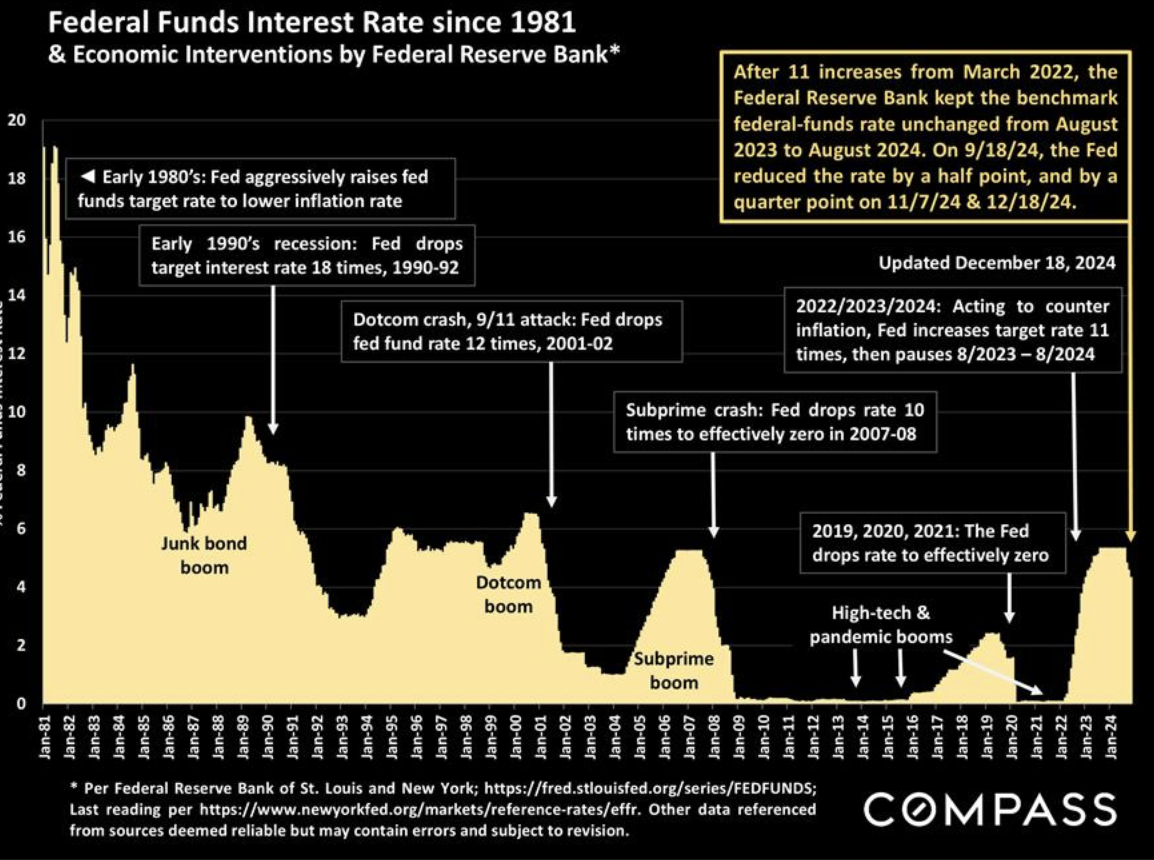

In September of last year the FED just began its interest rate

cutting cycle, but apparently not everyone "got the memo”.

While the FED cut the Fed Funds rate, a short term rate, longer

term rates, like mortgage rates, actually rose. As of this writing,

30 year mortgage money is still over 7%. More on the how and why

of this below.

The AV Land Market

The AV land market through out 2024 remained in a trading range

of 80 to 100 sales per month in our local MLS. As a reminder,

monthly land sales are at about 1/2 the level they were prior

to the FED raising interest rates in March of 2022. The effect

was not immediate, but as home sales slowed, so did land sales.

While the land market is slower, its not dead. The market has

a pulse, land is still being sold, but sales are mostly investor

sales vs developer purchases. Developers are “kicking the

tires” though, looking at possible purchases. In the chart

below you can see that 2023 and 2024 were about the same in

overall sales volume. Versus 2022, land sales in 2024 were down

-16.4%. Versus 2021, the last full year without FED interference,

2024 sales were down - 43.5%. As you may recall, it was in March

2022 that the FED began to raise interest rates, weakening that

asset class across the board. Conclusion: the Antelope Valley

land market remains in a confirmed “buyer’s market”,

with buyers having most of the leverage in negotiating price.

Antelope Valley Land Sales Activity

| |

Mo Sales |

Supply |

M /M |

Y / Y |

| 2021 |

1,920 total |

|

|

|

| 2022 |

1,297 total |

|

|

|

| |

|

|

|

|

| Jan 2023 |

73 |

2,338 |

+10.4% |

-53.5% |

| Feb |

75 |

2,308 |

+2.7% |

-35.0% |

| March |

118 |

2,333 |

+57.3% |

-7.1% |

| April |

102 |

2,317 |

-13.5% |

-32.8% |

| May |

79 |

2,313 |

-22.5% |

-29.4% |

| June |

68 |

2,375 |

-13.9% |

-49.2% |

| July |

79 |

2,427 |

+16.2% |

-25.2% |

| Aug |

84 |

2,438 |

+6.3% |

-6.6% |

| Sept |

117 |

2,425 |

+39.3% |

+56% |

| Oct |

95 |

2,388 |

-18.8% |

+10.5% |

| Nov |

89 |

2,536 |

- 6% |

-18.6% |

| Dec |

91 |

2,432 |

+2.2% |

+35.8% |

| Total |

1,070 / 89 p/mo vs 2021 - 44% |

|

|

|

| |

Mo Sales |

Supply |

M /M |

Y / Y |

| |

|

|

|

|

| Jan 2024 |

117 |

2,367 |

+28.5% |

+60.2% |

| Feb |

98 |

2,373 |

- 16.2% |

+30.6% |

| March |

95 |

2,350 |

- 3.0% |

-25.2% |

| April |

105 |

2,384 |

+10.5% |

+2.9% |

| May |

86 |

2,420 |

- 18% |

+8.8% |

| June |

80 |

2,460 |

-6.9% |

+17.6% |

| July |

91 |

2,437 |

+13.7% |

+15.1% |

| Aug |

78 |

2,453 |

- 14.2% |

- 7.1% |

| Sept |

80 |

2,464 |

+2.56% |

-32.6% |

| Oct |

105 |

2,461 |

+31.2% |

+10.5% |

| Nov |

67 |

2,452 |

-36.1% |

-24.7% |

| Dec |

82 |

2,369 |

+22.4% |

+ 11% |

| Total |

1,084 / 90 p/mo vs 2021 - 43.5% |

|

|

|

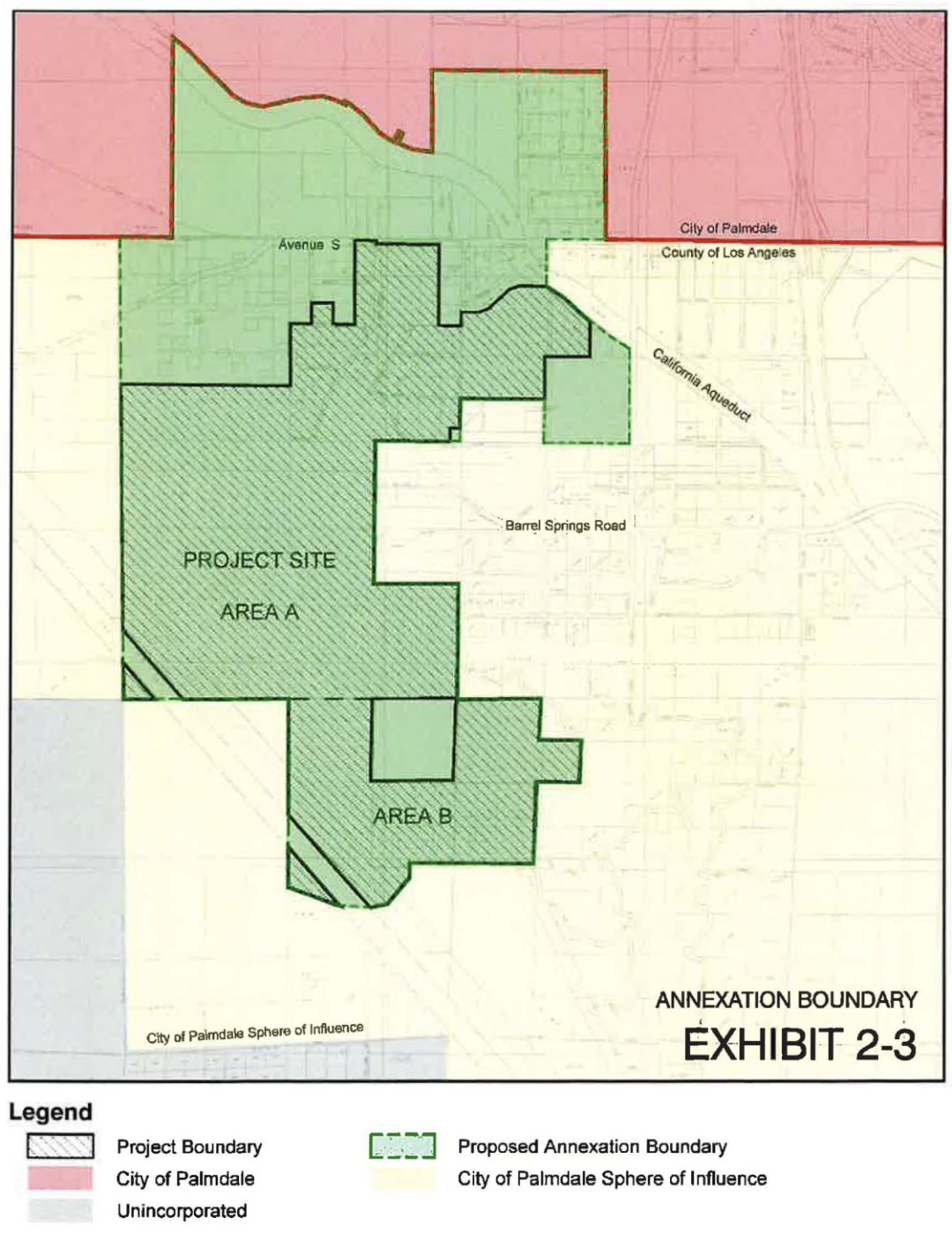

Antelope Valley News

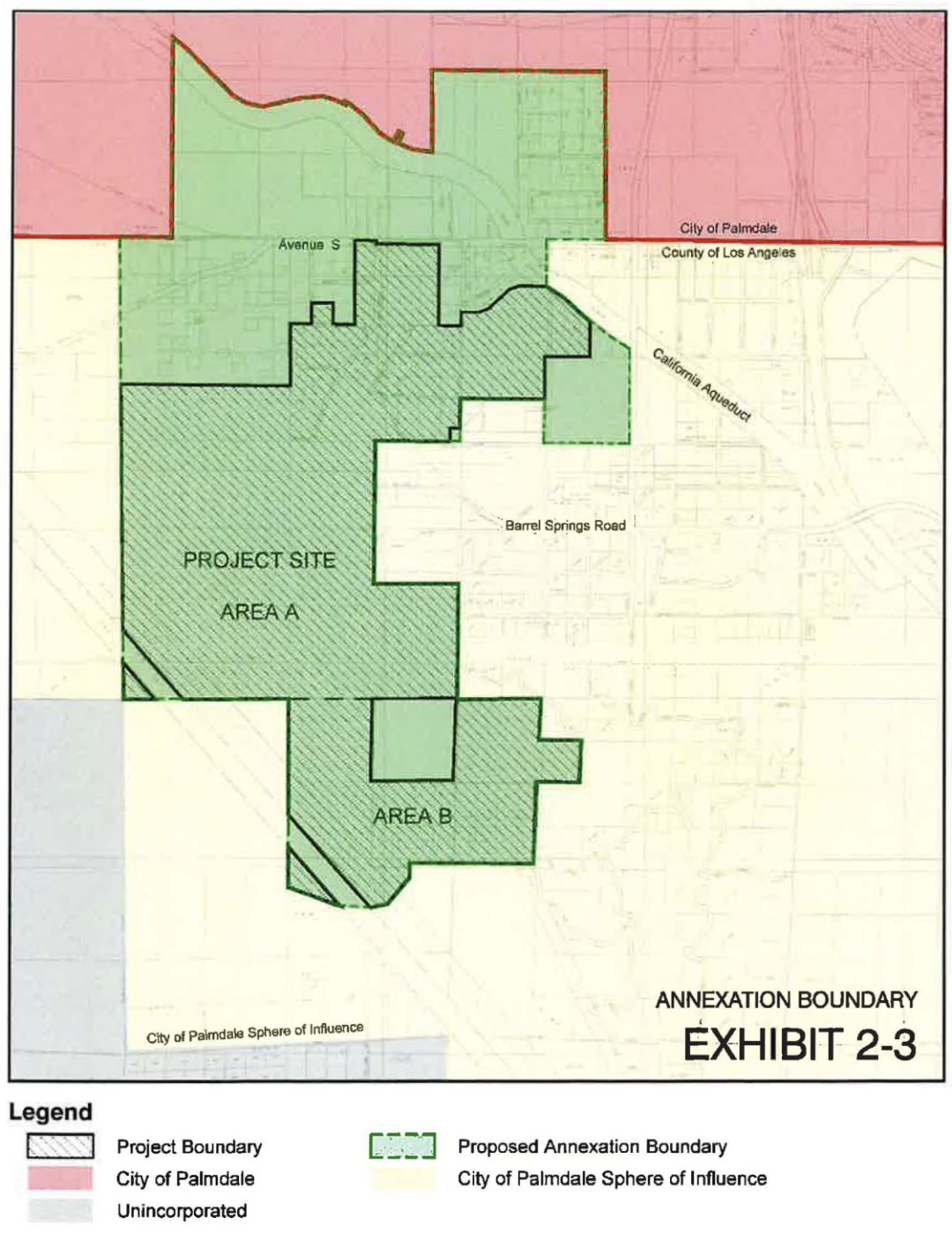

Nov 20- The City of Palmdale notifies,

by letter, all and owners in and around the Ava Verde area of

west Palmdale. The letter announces that huge amounts of acreage

are being annexed into the City of Palmdale, whereby now the area

is unincorporated. The land is being annexed into the City by

a developer for a residential project called Quail Valley Project.

The development will include 730 SF lots, with the lots being

1 acre and 1/2 acre in size. The land is south of Ave S and west

of Tovey Ave. The configuration is irregular and has both flat

areas and steep terrain. The tentativemap being worked up for

the project is numbered TM 65813.

What About Cal

Housing?

While the California housing market already

had its own challenges, the January fires will make those problems

even more complex. At first take, with 100’s of homes being

destroyed and removed from the market, one would think that less

supply would push prices up in the surviving areas. Months out,

that could happen, but it will take some time to play out. The

economy will also have its say that matter. This I do know, for

those that lost their home, even if they are fully insured, it

will be years until a replacement home is back up and finished.

Many home owners will opt to take their insurance money and buy

a home somewhere else. In Florida, after one of their hurricanes,

it took 4-5 years to get homes rebuilt. For those seeking

to rebuild in the affected areas, obtaining “affordable”

homeowners insurance will be an issue. In a few months, get ready

for stories hitting the TV news on the difficulty those seeking

to rebuild are having on getting through city, county, and state

regulations to get building permits. In LA County, regulatory

fees are approx 30% of the cost of a new home. In Cal, homes get

built in spite of government.

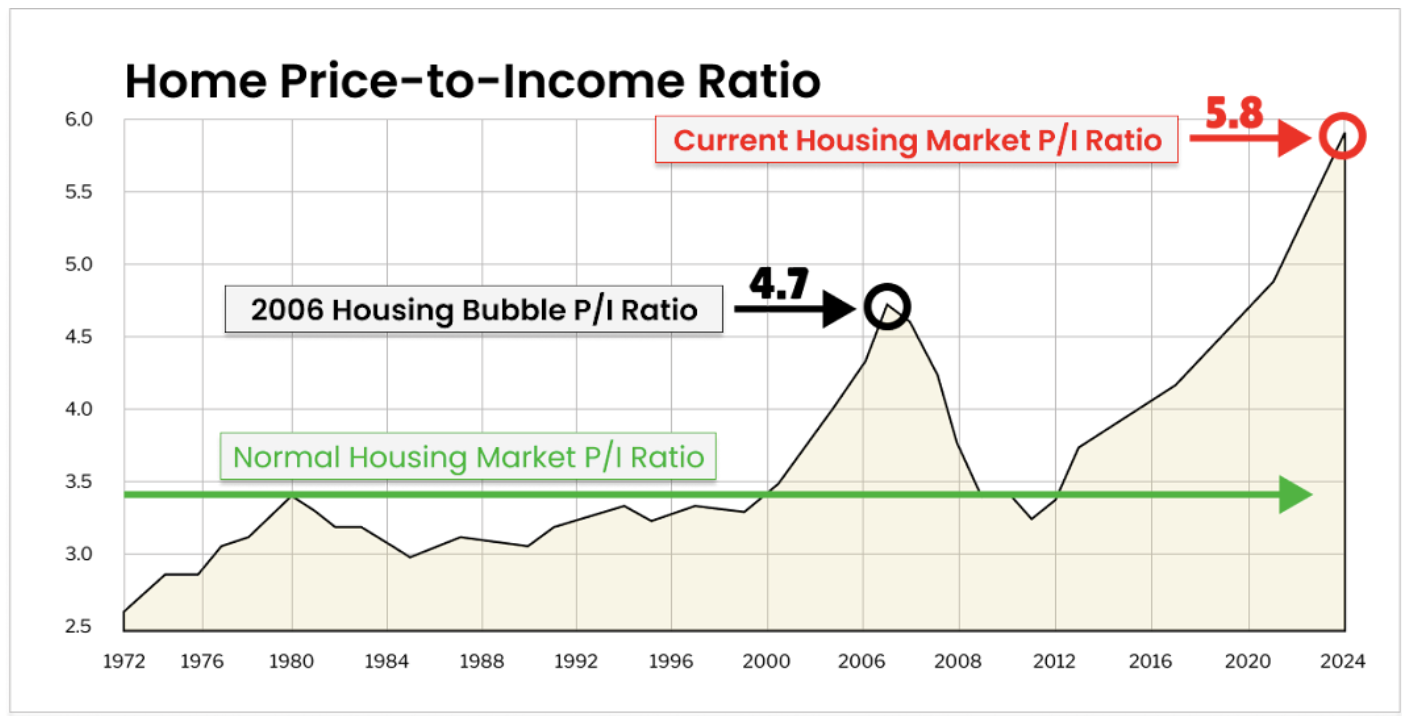

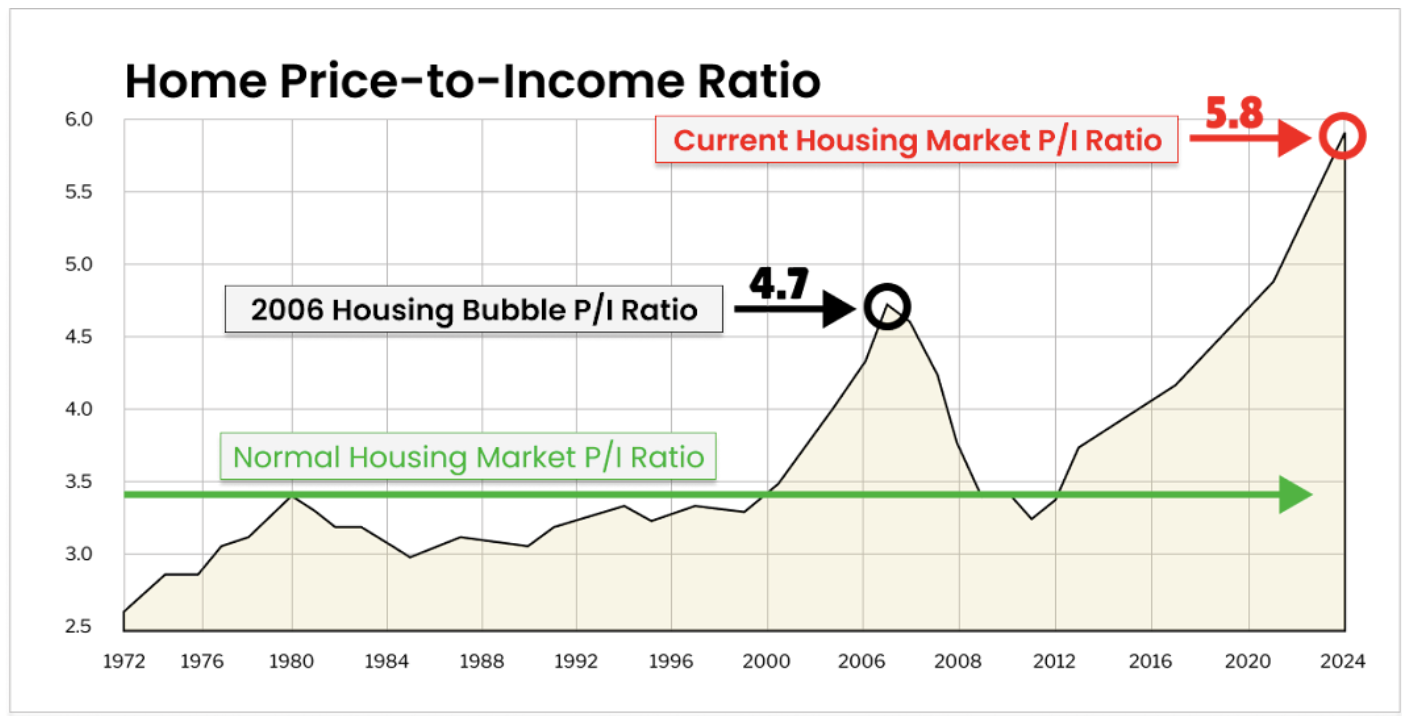

After a major run up in sales prices, I do not see housing prices

to continue this move up. This graph shows why. The gap

between the price of a home and income needed to buy a home, has

gone nearly parabolic. This gap launched in 2012 when the FF rate

was near zero and mortgage rates below 3%. Since 2020 alone, home

prices are up +50%. How much have incomes moved since 2020?

At best 10%. If adjusted for inflation, less.

As I see it, housing will muddle along over the next two years

as incomes play catch up and the housing market “digests”

these huge gains. More than likely, NO recession for housing,

just a slow down. The health of the housing

market is linked to interest rates, which in turn is linked to

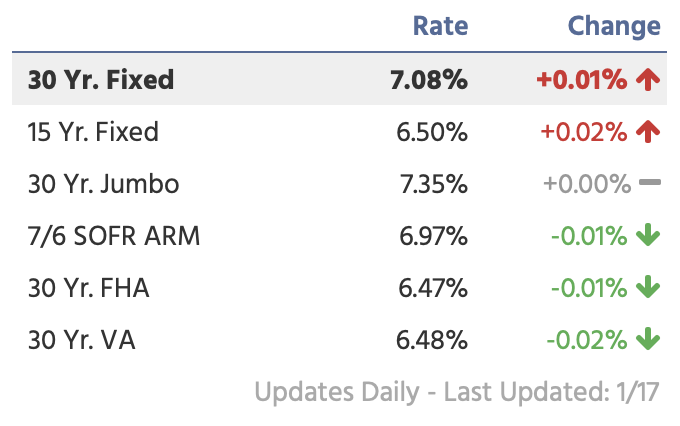

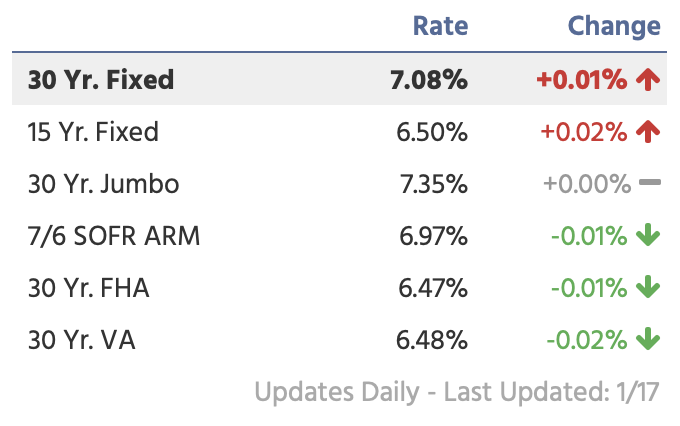

the inflation rate. More on that inter-relationship below.Mortgage

rates as of January 17th, 2025

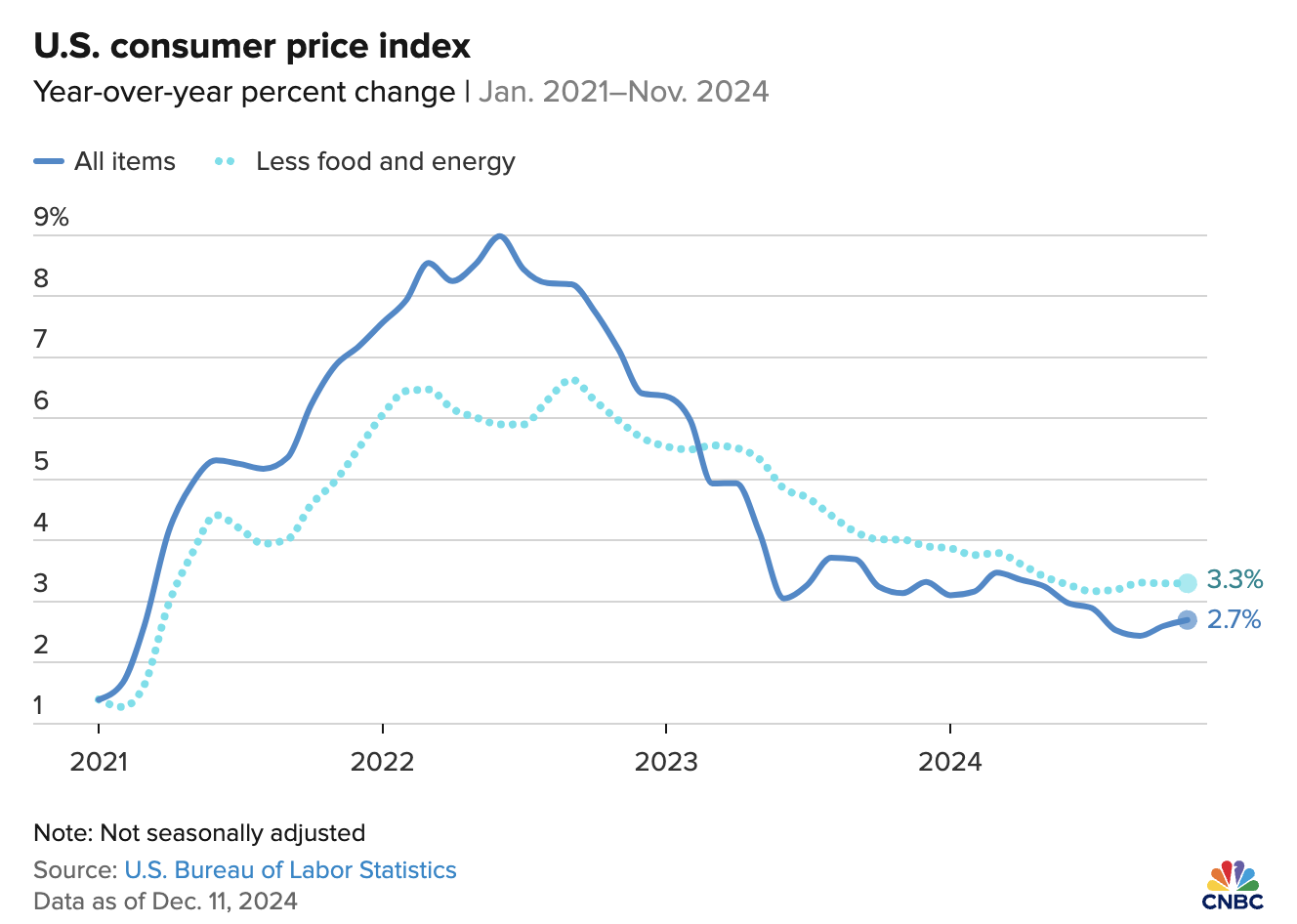

Inflation

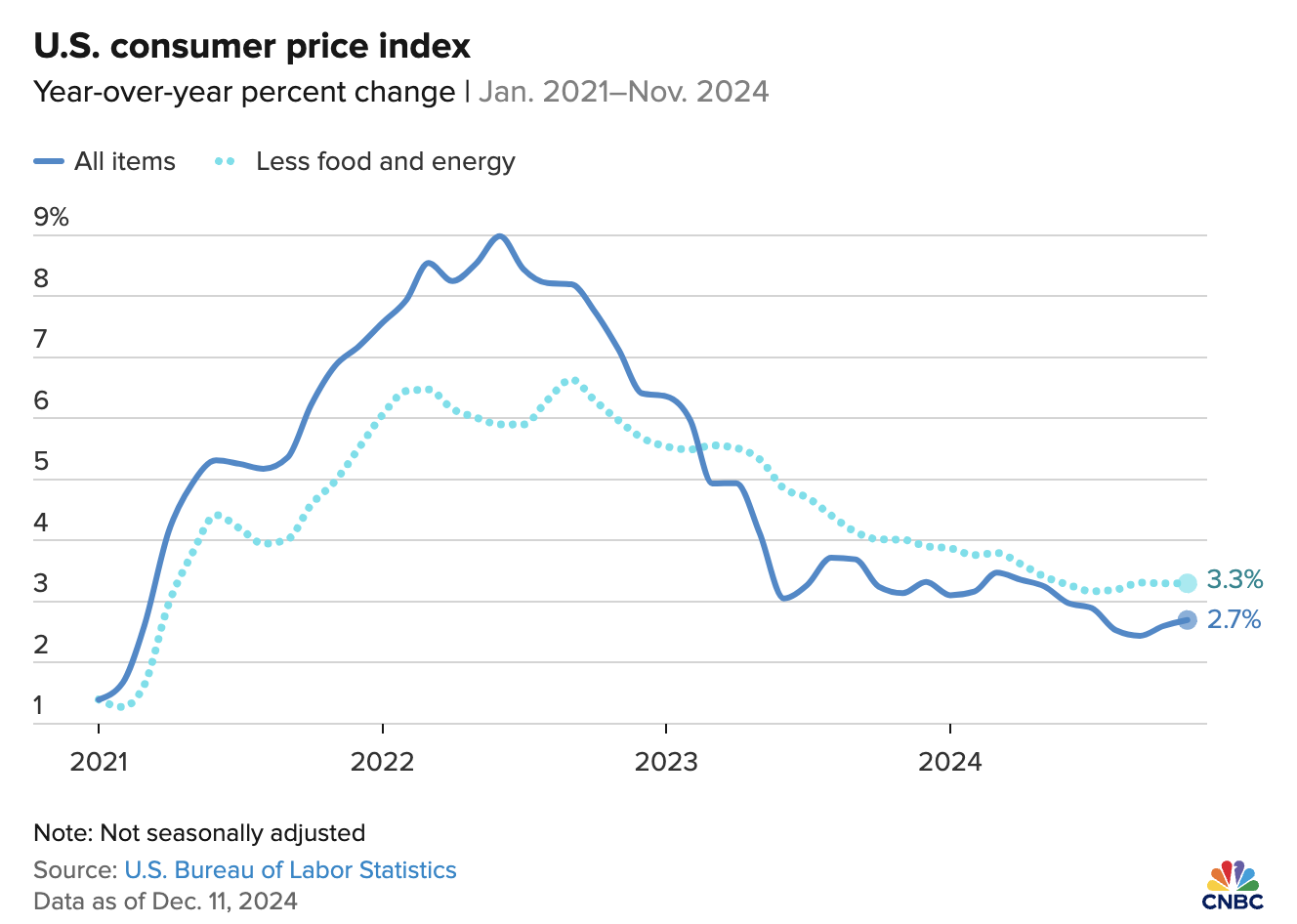

At this time, the only risk to the economy

would be rising inflation.At its peak, the CPI was at 9%. By raising

the Fed Funds rate, over time, the FED worked the inflation rate

lower. The most recent reading on the CPI

is from last December, +2.9% YoY. The FED still says that they

are aiming for an eventual inflation rate of 2%. Right now, on

a short term basis, the inflation rate is going in the wrong direction,

up not down, to reach 2%.

From 2010 through 2020, the CPI averaged between 2% and 2.5%,

so for the FED 2% is a logical target. Presently, the FED and

the Bond market are at war. While the FED has cut rates, the bond

market is fighting back against the widely held view that inflation

is no longer a threat. The Bond market is the private sector response

to the Board of Governors at the FED. When the Bond market raises

yields, it is acting as “governor” on public sector

policy of spending and borrowing. In the 1980’s when this

happened, financial institutions nicknamed the bond market, the

"Bond Market Vigilantes”. If the politicians would

not control spending and borrowing, then the Vigilantes would

push

interest rates up at bond auctions, which would slow the economy

and make it tougher to get reelected. At least for now, it looks

like the Bond Vigilantes

have returned.

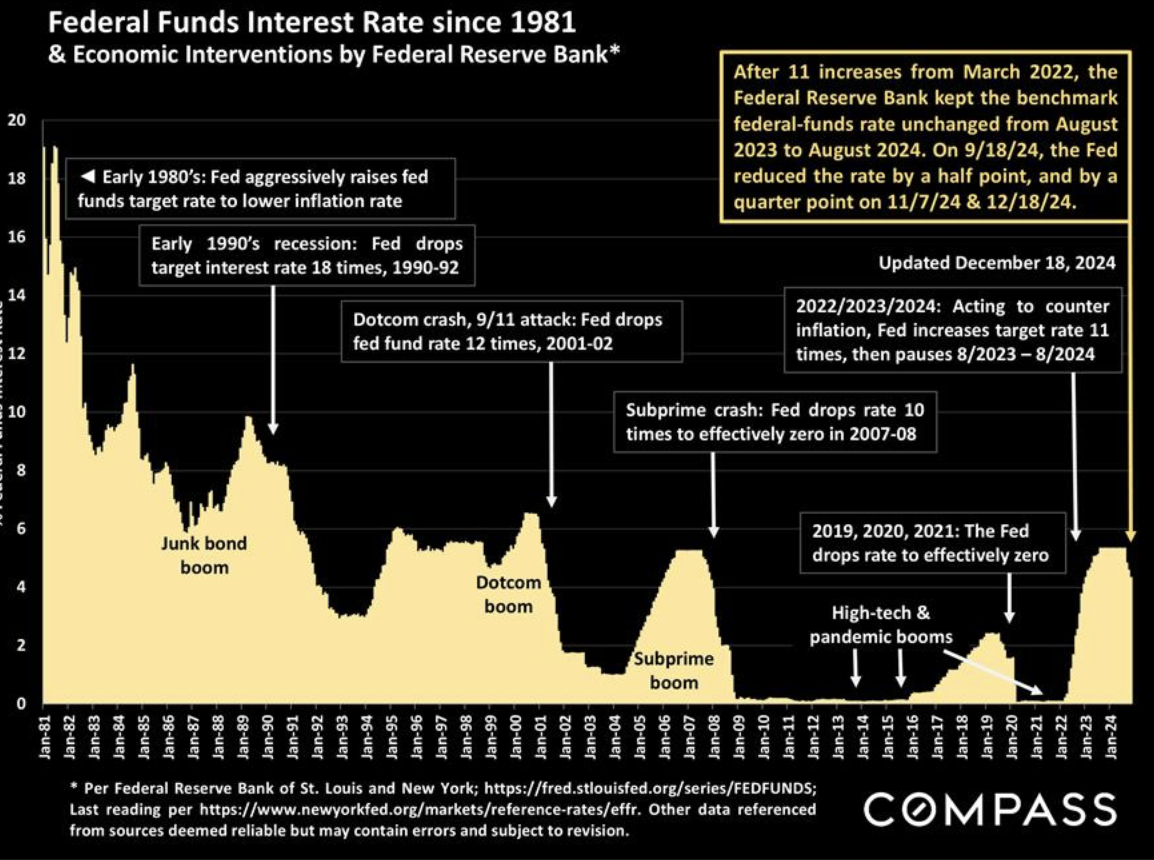

Interest Rates

On the chart below, last Sept 18th, just

as the FED began to reduce the FF rate, the inflation rate began

to rise again. In round numbers, the CPI rose from the low 2’s

to the 3% area. Also, during this same period, mortgage rates

also rose. This brings up an important point. While the FED controls

the Fed Funds rate, it does not control the interest rates at

which consumers borrow. Borrowingrates, essentially, follow the

perceived future inflation rate. This is done in the numerous

bond auctions held every month. When inflation is being perceived

as rising, financial institutions and investors, demand a higher

yield on the bonds they buy. And as bond yields rise, so do the

interest rates for consumers. So to conclude, the FED can only

influence interest rates, but not completely control them. In

times of low inflation, 2% or lower, the FED, the bond markets,

and borrowing

rates usually move in unison, in the same direction

From Reagan to Biden.

This line graph shows the

FED’s progress on fighting inflation since mid 2022. While

the FED has made progress, note that the core rate is still higher

than the headline CPI rate of 2.7%. A higher core rate indicates

that inflation is still having a major effect on the economy as

a whole, even not counting food and energy costs. Remember,

the FED spent 15 months (2021 & part of 2022) telling us that

the inflation at that time was only temporary.

This chart zooms in on 2024

and shows that inflation started a comeback last September. It

also shows that this comeback is flattening out. So, from here

the questions is, where does it go next? If the inflation rate

continues to rise, then borrowing rates will continue to rise.

And of course, the opposite could also happen.

The Economy

The only potential threat that I see to

the economy would be renewed rising inflation. When inflation

rises to constrictive levels, this happens:

- borrowing and lending dry up

- investment slows

- the economy slows

- business revenues also fall

- layoffs rise

- public loses confidence and pulls back on spending

- some businesses fail & close

- the unemployment rate rises

- foreclosure rates rise due to job losses, loss of income

- distress sales in the home market starts a spiral of declining

prices

The most recent GDP number on the US economy was Q 3 at +3.1%,

no where near recession. If we go below 1% GDP, it won’t

officially be a recession, but it sure will feel like one. The

somewhat official definition of a recession is two months in a

row of growth below 0%, which would mean that the economy is actually

contracting / shrinking.Right now the US economy is nowhere near

recession. In the first 3 - 6 months of of 2025, a series of Trump

policies that are pro-growth are going to hit the economy, i.e.,

possible tax cuts and removal of 100’s of regulations that

quietly can strangle an economy. If legislation goes as planned,

the 2nd half of 2025 should be stronger. In taking a look at all

the "pieces are on the board”, I see no reason not

to be optimistic for 2025. However, there is always a caveat,

and that caveat would be what happens if inflation has a 2nd leg

up. If the CPI were to go above 4% that would mean 8% mortgages

and that would certainly lead to slower sales and falling home

values. As I said in my last Special Bulletin, I put a very low

probability on inflation rising dramatically…………..but

keep your eye on the inflation rate and that will tell you all

you need to know on the direction of the economy.

Questions? Need help or advice?

Call OR email.

Jim Patton, Broker

http://www.avLand.info

“since 1985, helping investors make

informed decisions"

BRE # 00776290

Office, outside AV 800-270-8770

Office, inside AV 661-943-8090

Fax - 661-793-7269

Jim Patton

jim@jpbroker.com

|